personal tax season is here! we can help you! don't miss the deadline! maximize your savings with us!

Personal Tax Filing Deadline for Tax Year 2024:

April 15, 2025

Time Left to File Your Taxes...

Don't Delay!

We Can Help!

every unique tax situation, no matter how complex you think it is.

File your Corporate Taxes with ease!

We are experts! Let us help you so that you can focus on growing your business.

unique financial situation and goals so that we can deliver optimal results, every time.

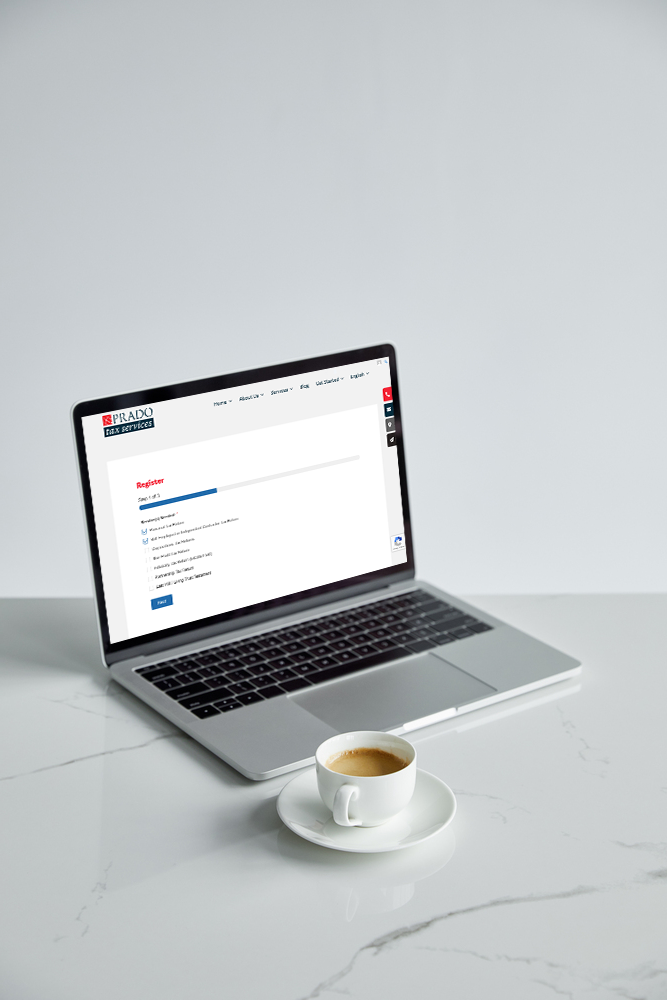

FILE YOUR TAXES WITH CONFIDENCE ONLINE

CORP & LLC TAX FILING

6 Easy Steps to File Taxes Online

We’re confident you’ll find our tax filing solutions convenient – whether you use a computer, tablet or a smartphone. The process is the same for all devices.

Below you’ll find a step-by-step guide of how it works.

1

2

3

4

5

6

Features & Benefits of Filing Online

Filing Online with Prado is Easy Convenient Secure

EASY

Getting started to file your taxes online is easy with Prado Tax. Our dynamic online tax checklist takes the guesswork out and lets you know exactly what information and documentation you’ll need for us to file your tax returns. Once you are registered in our system, you can upload your documents to expedite the process.

CONVENIENT

Whether you prefer a desktop computer or your mobile device, our online solution delivers a user experience as effective as if you were in the office in-person. Our enhanced checklist form is designed to quickly establish your tax profile. This is what allows us to file your taxes accurately and focus on what’s important to you.

SECURE

Our new platform uses the most advanced technology proven to keep your data safe and secure. Not only that, but we never sell your data, unlike other tax services out there. We treat your data with the highest level of integrity, like we would if it were our own.

Why Choose Us

We realize you have many options when it comes to filing your taxes. Though it's important to make sure that your tax preparer understands your needs and can deliver optimal results. We invite you to get to know us and understand the values we choose to operate everyday!

Personal

Professional

Trustworthy

See What Our Clients Are Saying...

How We Compare to Other Tax Services

Finding a solid, honest and reputable tax filing service can prove to be a daunting task for some. You want to make sure you are well taken care of, and that your taxes are filed accurately by an experienced professional that you can trust without hassle. While people and businesses have many options to choose from, not all tax preparation services are created equal. The information below provides a general overview of how Prado Tax Services compares to others in the industry, so you decide!

| Prado Tax | Other Providers | DIY Online Services | |

|---|---|---|---|

| Personal Service | As a valued client of Prado Tax Services, you can expect nothing less than a top-tier, personalized service experience that's tailored to meet your unique needs and help you achieve your financial goals. Our commitment to excellence means that we take the time to truly understand your individual situation and work closely with you to develop a customized solution that will help you maximize your savings potential and achieve financial success. With Prado Tax Services, you can rest assured that you're in good hands and that your financial future is in the best possible hands. | Other providers (larger companies in particular) simply cannot provide a personal experience because of the volume that they process each tax year. This often means you are just another number for them to process. | When you choose a do-it-yourself tax filing software, you are on your own. If you need service or support, you either have to call a service line, or read through self-guided documentation to figure out complex tax matters. |

| Experience | We proudly opened our doors in the Bay Area over 18 years ago with a singular vision - to deliver unparalleled and accurate tax services that take the guesswork out of taxes for both individuals, families, and businesses alike. Throughout the years, we have remained steadfast in our commitment to providing a streamlined and trustworthy service, leveraging on the latest technologies and industry-leading practices to ensure our clients receive the best possible tax advice and assistance. With a wealth of experience and deep expertise in the tax industry, we are confident that we can help you navigate the complex tax landscape, minimize liabilities, and help you achieve long-term financial success. | Many others recruit and hire people that have zero experience and knowledge in tax. Other low-cost providers claim to have the experience required, but are often unable to answer solid advice when for complex tax matters. | Unless you are a certified tax preparer or a CPA, most individuals and business owners lack the experience to understand the ever-changing U.S. tax code and all the nuances that impact the filing of personal and corporate taxes. |

| Security | We understand the importance of data safety and security in today's digital age. That's why we have taken ample time and invested a substantial amount to design and develop an exceptional IT infrastructure. Our team has carefully selected and utilized the most efficient and secure technologies to ensure that your data is safeguarded against all potential threats. We have implemented the latest firewalls, encryption, and backup systems, among other protective measures to give you peace of mind. Rest assured that your data is in safe hands with us. | Smaller providers often working from a home office, basement or garage simply do not have the IT infrastructure, firewall power and investments to ensure your data is kept away from cybercriminals. | While consumer tax software is built securely, consumers that do not have a strong internet security infrastructure of use passwords that are easy to crack open themselves up to cyber attacks. |

| Accuracy | At Prado Tax, we take pride in providing exceptional tax services. Unlike others, we don't outsource any of our work - everything is performed in-house at our corporate office located in the bustling city of San Leandro, California, in the United States of America. Our team of experienced professionals works tirelessly year-round to ensure that our clients receive personalized attention, timely assistance, and accurate tax advice. With Prado Tax, you can rest assured that your tax needs are in the best hands. | Every year, many clients that left to try someone else come back to us, because their provider may have overlooked something along the way, or they were simply not sure their taxes were filed in a way that optimized their savings. | Quite often, online tax preparation software is not up-to-date on all the tax legislation. As a result, consumers may file taxes inaccurately, requiring them to amend their return in order to address missed opportunities. |

| Outsourcing | Before we proceed with filing your taxes, we at Prado Tax, take our client's tax-related matters very seriously. Our team of experts goes through a comprehensive checklist and review process to identify all possible errors as well as potential audit risks. We leave no stone unturned in ensuring your tax-filing experience is hassle-free and you get nothing but the best. With our diligent approach, we guarantee that if ever a mistake is discovered, our guarantee covers any penalties and interest due. So, you can rest assured that your taxes are in safe hands! | We have noticed that some other service providers tend to outsource sensitive client data offshore to reduce their operational costs. However, this outsourcing practice can increase the risk of compromising the security of the data. | Development and Support for do-it-yourself tax preparation software is often overseas. Additionally, often users are given a plethora of documents to read through for self-help. |

As a valued client of Prado Tax Services, you can expect nothing less than a top-tier, personalized service experience that’s tailored to meet your unique needs and help you achieve your financial goals. Our commitment to excellence means that we take the time to truly understand your individual situation and work closely with you to develop a customized solution that will help you maximize your savings potential and achieve financial success. With Prado Tax Services, you can rest assured that you’re in good hands and that your financial future is in the best possible hands.

Other providers (larger companies in particular) simply cannot provide a personal experience because of the volume that they process each tax year. This often means you are just another number for them to process.

When you choose a do-it-yourself tax filing software, you are on your own. If you need service or support, you either have to call a service line, or read through self-guided documentation to figure out complex tax matters.

We proudly opened our doors in the Bay Area over 18 years ago with a singular vision – to deliver unparalleled and accurate tax services that take the guesswork out of taxes for both individuals, families, and businesses alike. Throughout the years, we have remained steadfast in our commitment to providing a streamlined and trustworthy service, leveraging on the latest technologies and industry-leading practices to ensure our clients receive the best possible tax advice and assistance. With a wealth of experience and deep expertise in the tax industry, we are confident that we can help you navigate the complex tax landscape, minimize liabilities, and help you achieve long-term financial success.

Many others recruit and hire people that have zero experience and knowledge in tax. Other low-cost providers claim to have the experience required, but are often unable to answer solid advice when for complex tax matters.

Unless you are a certified tax preparer or a CPA, most individuals and business owners lack the experience to understand the ever-changing U.S. tax code and all the nuances that impact the filing of personal and corporate taxes.

Smaller providers often working from a home office, basement or garage simply do not have the IT infrastructure, firewall power and investments to ensure your data is kept away from cybercriminals.

While consumer tax software is built securely, consumers that do not have a strong internet security infrastructure of use passwords that are easy to crack open themselves up to cyber attacks.

At Prado Tax, we take pride in providing exceptional tax services. Unlike others, we don’t outsource any of our work – everything is performed in-house at our corporate office located in the bustling city of San Leandro, California, in the United States of America. Our team of experienced professionals works tirelessly year-round to ensure that our clients receive personalized attention, timely assistance, and accurate tax advice. With Prado Tax, you can rest assured that your tax needs are in the best hands.

Every year, many clients that left to try someone else come back to us, because their provider may have overlooked something along the way, or they were simply not sure their taxes were filed in a way that optimized their savings.

Quite often, online tax preparation software is not up-to-date on all the tax legislation. As a result, consumers may file taxes inaccurately, requiring them to amend their return in order to address missed opportunities.

Before we proceed with filing your taxes, we at Prado Tax, take our client’s tax-related matters very seriously. Our team of experts goes through a comprehensive checklist and review process to identify all possible errors as well as potential audit risks. We leave no stone unturned in ensuring your tax-filing experience is hassle-free and you get nothing but the best. With our diligent approach, we guarantee that if ever a mistake is discovered, our guarantee covers any penalties and interest due. So, you can rest assured that your taxes are in safe hands!

We have noticed that some other service providers tend to outsource sensitive client data offshore to reduce their operational costs. However, this outsourcing practice can increase the risk of compromising the security of the data.

Development and Support for do-it-yourself tax preparation software is often overseas. Additionally, often users are given a plethora of documents to read through for self-help.

Stay Informed with our Blog

Introduction As we move into 2025, it’s more important than ever for families in San Francisco to stay up-to-date with the latest tax policies, especially when it comes to credits........ Read more

Introduction Many believe a CPA is necessary for tax filing; however, this is incorrect. CPAs in the Bay Area specialize in accounting and financial planning, but they often do not........ Read more

Introduction Choosing the right tax preparer in the Bay Area is crucial for individuals and businesses. Tax regulations can be complex, and working with a qualified professional ensures accuracy, compliance,........ Read more

Frequently Asked Questions

How Secure Is Prado's online tax filing?

Prado Tax prioritizes the safety and security of our clients' confidential information. Therefore, we implement stringent measures to ensure that your data is always safeguarded with utmost care. To achieve this, we have established a policy whereby all confidential information is not stored on our website but rather stored with our cloud-based platform for heightened security. Our advanced technology platform ensures that the security of your information is guaranteed, giving you the peace of mind you deserve. Rest assured that your trust in us is not misplaced as we constantly go above and beyond to provide you with the best security standards available.

How Do I Upload My Documents?

How Long Does the process take?

When it comes to the time frame for completing your tax return with Prado, you are in complete control. Once all your required documents are submitted, we'll complete your tax return quickly and efficiently. However, if you are still waiting on certain required documents, it may take longer. Don't worry though - our enhanced workflow makes it easy for you to stay on top of everything and ensures that the process remains as convenient as possible for you at all times. So, take control of your taxes and let Prado Tax help you every step of the way.

Be sure to watch this video to learn more about how it works and click here to get started.

Can I Still Claim My Property Tax In California?

Yes, it is entirely possible for you to claim your State and local real estate taxes (subject to Federal limitations) while filing your tax returns. This means that you can benefit from tax deductions and lower your overall tax liability for the year. However, it is crucial to understand the Federal limitations and regulations that may apply to your specific situation before making any claims. By following the rules and guidelines set forth by the IRS, you can ensure that you are taking full advantage of the tax benefits available to you. So, be informed and maximize your tax savings!