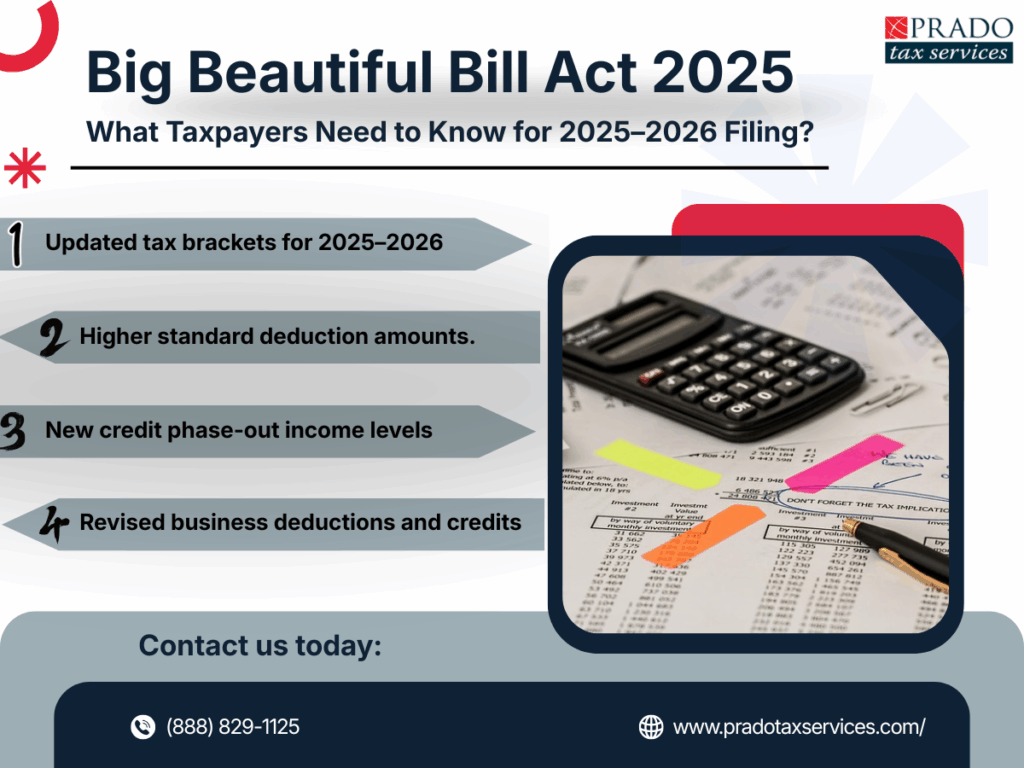

Before you start your 2025 and 2026 income tax filing, the Big Beautiful Bill Act 2025 has already shifted the ground under your feet. Some rules feel familiar, but others nudge your return in a new direction without warning. Brackets adjusted. Credits moved around. A few deductions changed in quiet ways that don’t look big on paper but still show up in the final refund total. The whole process feels different enough that people are talking about their income tax filing earlier this season than they usually do.

Why this new law matters more than people think?

The Big Beautiful Bill Act 2025 is not a small tune-up. It affects how people plan money, and it changes the rhythm of income tax filing in ways that filers feel as soon as they open their software. A bracket shift here, a phase-out change there, and suddenly the return you expected doesn’t look like the one on your screen. Many people are leaning on tax filing services earlier because the tiny details inside this law ripple through the entire return.

Most filers assume last year’s setup will work again. Except this year, it won’t. A small bump in earnings from a side job or a forgotten deduction can force your numbers into a space you didn’t expect. When that happens, your personal tax preparation services plan needs a fresh look. Even people who file confidently say the math feels different this year. That moment where the refund drops or jumps pushes more people toward using tax filing services instead of rushing through forms.

Business owners feel the law in an even stronger way. Updates to credit rules and deduction structures make business tax preparation services more important for companies trying to plan. The law may read clean, but filing through it takes more attention than people expect. Many owners now treat the new rules as a reason to revise their income tax filing process completely.

What actually changed under the big beautiful bill act 2025?

Instead of reading hundreds of pages, here’s what actually shapes income tax filing for 2025 and 2026. These changes affect tax filing services, personal tax preparation services, business tax preparation services, and the way people approach the season.

Updated tax brackets

Several brackets widened, making some filers fall into slightly lower rates even with higher income. This shapes how personal tax preparation services read your return and how your income tax filing plays out once all numbers are entered.

Bigger standard deduction

Most filers will see an increase in the standard deduction, and the updated numbers appear in the IRS release on tax inflation adjustments for 2026

People who don’t itemize will feel this the most, and it helps smooth out years with uneven earnings.

Credits that shifted

Some credits now phase out at new income levels. Anyone relying on these during income tax preparation will see differences. This part is where personal tax preparation services matter because a small change can move your refund.

Business credit adjustments

Updated limits and thresholds shape how companies plan deductions and expenses, and these changes affect income tax filing for owners who balance several income sources. Business tax preparation services now review credit eligibility more carefully because the new rules affect budgets and influence how income tax filing fits into the company’s yearly plan.

Cleaned-up deduction rules

Some deductions tightened while others became easier to claim, and both shifts show up during income tax filing when people compare last year’s numbers with the new structure. Filers using tax preparation help will notice more guidance in this area because the law changed what counts and what doesn’t.

How do these rules shape your 2025 and 2026 income tax filing?

A quick check of the numbers

Filers often begin their income tax filing thinking everything looks the same, but the updated rules from the Big Beautiful Bill Act 2025 appear fast. The software loads your forms, the numbers shift, and suddenly, the refund is nothing like last year’s. Many people contact tax filing services at that exact moment because the return doesn’t behave the way they expected.

What filers skip without meaning to?

The bigger standard deduction changes how people compare itemizing with taking the default. It also changes how tax filing services review your return. When people hurry through income tax filing, these changes slip by without notice.

Credits land differently now

Credits that felt predictable in past years now depend more on income level. Personal tax preparation services review these ranges closely because even a small income shift can change your refund. This is why so many filers use tax filing services instead of taking chances.

Business income needs more care

Companies feel the updated limits through deductions, credit timing, and expense structure. Business owners balancing personal and company income often turn to tax filing services because mixed income creates new challenges.

When you need a reliable review?

Many filers want another set of eyes on their income tax filing when the numbers feel uncertain, which is why so many people rely on our tax filing services for a second look at the new rules.

Personal tax preparation services: What filers should rethink this year?

The new law changes how people approach personal tax preparation services. Credits move. Deductions shift. A return that once felt simple now needs more careful review. Income tax filing is more connected to these small changes, which is why so many filers ask for help earlier in the season.

Many people who handled their own income tax filing in the past now want personal tax services that understand these updates. A missed credit or deduction can shrink a refund, and the new rules make those mistakes easier to miss. When people see their totals drop unexpectedly, they look for personal tax preparation services to review everything again, and some also choose Bay Area tax services when they want support that feels more local and familiar.

Why business taxes hit different this year?

Business owners already manage enough moving parts, and the Big Beautiful Bill Act 2025 adds new ones. These changes affect business tax preparation services more directly because the credit rules and deduction structures reshape annual planning.

What stands out for most companies?

- Credit thresholds shifted in ways that affect income tax filing for mixed earners

• Expense timing matters more under the new deduction rules

• Businesses using tax filing services now compare last year’s numbers more carefully

These updates change how companies review their year. A credit that once helped might not apply this time. A deduction that saved money last year might need a different timing. Business tax preparation services now give each return a closer, slower review.

When planning gets layered?

For owners who combine business and personal income, these updates complicate income tax filing. One small change in income can shift the entire return. Many rely on business tax preparation services to keep everything steady.When the new rules feel confusing, leaning on business tax preparation services gives you a clearer path forward.

How tax filing assistance makes this year easier?

A lot of people start filing confident, then pause when the numbers behave differently. The new rules make tax filing assistance more useful because income tax filing doesn’t respond the same way it did in earlier seasons. Credits don’t act the same. Brackets shift totals. The bigger standard deduction changes refund expectations.

Tax preparation help gives people a way to slow down and confirm the return is correct. Many filers say they now want a review even if they normally file without support. When people realize how many parts of the return connect to the new law, they often reach out for tax filing services simply for clarity, especially those who prefer guidance from Bay Area tax services during a more complicated filing year.

Your Bay Area tax services advantage

Filing under this new law becomes easier with local guidance. People using Bay Area tax services benefit from support that understands how local income sources, side work, business growth, and cost-of-living changes shape returns. National programs cannot match that local view.

Local tax pros know the patterns, the common mistakes, and the parts of income tax filing that Bay Area residents ask about every year. Filers with variable income or small business earnings often say Bay Area tax services help them see a clearer path forward.

Closing thoughts for this filing Season

The Big Beautiful Bill Act 2025 reshaped more of the tax landscape than most people expected. Once you start working through your return, you can feel how the new brackets, credits, and deduction rules shift the flow of income tax filing. It isn’t complicated, but it does ask you to slow down, check the numbers twice, and pay attention to details that might have been automatic in past years.

When the rules change, filing becomes less about rushing to the finish and more about understanding how those changes affect your year. That’s why so many people are leaning on tax filing services, personal tax preparation services, and business tax preparation support to keep things steady. For people in the region, working with Bay Area tax services can make that process feel more grounded and easier to follow.

The updated law may feel big at first, but once you move through it step by step, it becomes manageable. The key is taking the time to handle your income tax filing in a way that fits the new rules and your own financial story.