A business tax audit is a comprehensive review of a company’s financial records to ensure compliance with federal, state, and local tax laws. Conducted by the IRS, California state authorities, or San Francisco city officials, these audits verify income, deductions, and credits to identify discrepancies. While audits can seem daunting, adequate preparation ensures your business stays compliant and avoids penalties.

San Francisco has its own set of tax regulations, including the gross receipts tax and commercial rent tax, which make navigating a tax audit slightly more complex than in other regions. By understanding the audit process and meeting specific requirements, businesses can minimize risks and protect their financial health.

Related Article: Facing an IRS Audit? A Tax Consultant can help you in SAN FRANCISCO

Requirements for a Business Tax Audit in San Francisco

Mandatory Documentation

Before a business tax audit begins, gathering the right documents is crucial. Here’s what local San Francisco businesses should prepare:

- Business Licenses and Permits: Ensure you have valid local permits and licenses for your operations.

- Local Tax Filings: Include payroll tax filings, city-specific tax returns, and any other relevant records.

- Financial Statements: Maintain accurate profit and loss reports, balance sheets, and cash flow statements for at least three years.

San Francisco Tax Regulations

San Francisco imposes unique tax obligations that businesses must comply with:

- Gross Receipts Tax: Calculated based on a company’s annual revenue, with varying rates depending on the industry.

- Commercial Rent Tax: Applicable to businesses renting commercial properties in the city.

- Small Business Exemptions: Ensure eligibility for small business tax thresholds to reduce liabilities.

Understanding these local requirements can help businesses avoid discrepancies during a business tax audit.

IRS and State Compliance

In addition to city-specific requirements, businesses must also comply with federal and California state tax laws. Accurate federal filings, along with state income and sales tax reports, are critical for smooth business tax audit proceedings.

How Does the IRS Conduct Business Tax Audits?

Notification Process

The IRS begins a tax audit by sending an official letter. Avoid scams by noting that they never initiate contact via phone or email. The letter will specify the type of tax audit (correspondence, office, or field) and a list of required documents.

Types of Tax Audits

- Correspondence Audits: These audits are managed through the mail, and they require businesses to submit specific financial records.

- Office Audits: Conducted at an IRS office, where taxpayers present and discuss their financial documents.

- Field Audits: The most comprehensive type, where IRS agents visit the business location to examine records and operations firsthand.

Areas of Focus

The IRS typically scrutinizes:

- Accurate income reporting.

- Validation of deductions and credits.

- Payroll taxes and compliance with employment-related tax rules.

Resolution Process

After the audit is completed, the IRS will either:

- Accept the tax return as filed.

- Propose changes requiring additional taxes or penalties.

Businesses that disagree with the findings can appeal the decision or request mediation.

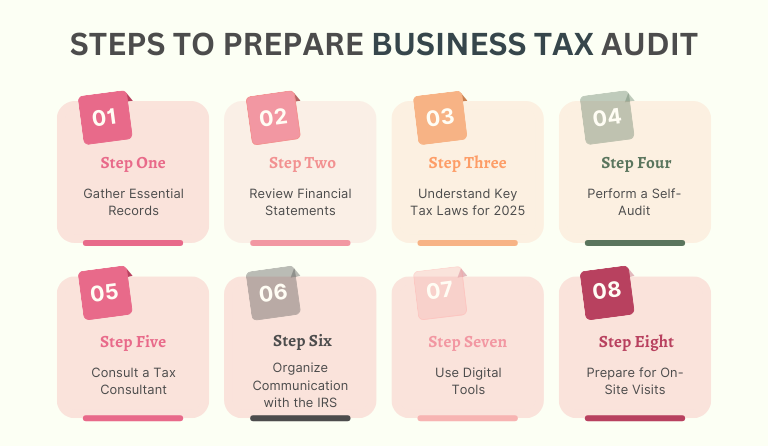

Step-by-Step Guide to Prepare for a Business Tax Audit

Step 1: Gather Essential Records

Compile your tax returns for the past three to five years. Organize invoices, receipts, payroll reports, and expense logs. Ensure both paper and digital records are consistent and accessible for the business tax audit.

Step 2: Review Financial Statements

Carefully examine your profit and loss statements, balance sheets, and cash flow records. Cross-check that reported income matches financial transactions to avoid discrepancies during the business tax audit.

Step 3: Understand Key Tax Laws for 2025

Research changes to federal and state tax laws affecting your industry. Note any updates to deductible expenses, credits, or income thresholds that may impact your filings. Staying informed minimizes risks during a tax audit.

Step 4: Perform a Self-Audit

Review your financial records from the perspective of an auditor:

- Reconcile bank statements with reported income.

- Check for unusual entries or red flags, such as missing documentation for significant deductions.

- Proactively address errors or prepare explanations.

Step 5: Consult a Tax Consultant

A professional tax preparer and consultant who is well-versed in San Francisco’s local tax regulations, California state tax laws, and federal tax regulations can help identify potential triggers for a tax audit. They can also assist in organizing records and communicating with authorities during the tax audit.

Step 6: Organize Communication with the IRS

Designate a knowledgeable point of contact within your business to liaise with IRS officials. This person should be prepared to clarify unusual transactions or complex financial entries during the business tax audit.

Step 7: Use Digital Tools

Leverage accounting software such as QuickBooks or Xero for precise financial tracking. The IRS also recommends e-filing tools for streamlined compliance during a business tax audit.

Step 8: Prepare for On-Site Visits

For field audits, set up a dedicated workspace for the auditor. Ensure all relevant team members are informed and available to address inquiries. Professionalism during on-site visits leaves a positive impression during the business tax audit.

Tips for San Francisco Businesses

- Stay Informed: Attend local tax workshops to stay updated on San Francisco’s tax regulations and reduce audit risks.

- Leverage Associations: Join small business associations for resources and guidance on city-specific tax issues.

- Subscribe to Updates: Keep up with government bulletins for tax law changes that could impact your business.

- Consult Professional Tax Preparers: Partnering with a professional tax preparer like Prado Tax Services can significantly reduce the risk of tax audits. A tax preparer ensures your filings are accurate, compliant, and aligned with both local and federal regulations. By working with experts, you can identify potential audit triggers in advance, maintain proper documentation, and confidently manage your tax obligations.

Conclusion

Preparing for a business tax audit in San Francisco requires thorough planning and a solid understanding of local, state, and federal tax laws. By organizing essential records, staying informed about regulations, and consulting a professional tax preparer, businesses can navigate the tax audit process with confidence.

Partner with Prado Tax Services today for reliable, tailored tax solutions to safeguard your business and minimize audit risks. Our team of professionals ensures that your records are audit-ready and compliant with San Francisco’s unique tax laws. Contact us today for reliable and efficient tax support tailored to your business needs.