Missing the business tax deadline 2025 can feel overwhelming, especially when penalties and interest start adding up. But there’s good news, you may still have options. Filing a business tax extension can give you more time to organize your records, reduce errors, and avoid late filing penalties.

In this guide, we’ll walk you through everything you need to know about filing a business tax extension 2025, the forms involved, how to estimate your taxes, and how tax experts can help keep your business on track.

What Is a Business Tax Extension?

A business tax extension is a formal request to the IRS for additional time to file your business tax return. It does not extend the time to pay taxes owed, but it gives you more breathing room to prepare and submit your return accurately. This is especially useful for business owners dealing with complex finances, pending documentation, or unexpected delays.

For 2025, the IRS allows eligible business entities to file Form 7004 to request a tax extension 2025. Once approved, the extension typically grants an additional 5 or 6 months to file your full business tax return.

However, don’t confuse an extension to file with an extension to pay. If you owe taxes, your estimated payment is still due by the original tax deadline 2025.

IRS Deadlines for Business Taxes in 2025

Different types of businesses face different business tax filing deadlines. Knowing your entity type and its corresponding tax deadline 2025 is the first step in staying compliant:

- Partnerships & S-Corporations: Due by March 17, 2025

- C-Corporations: Due by April 15, 2025

- Extended deadlines:

- September 15, 2025 (for partnerships and S-corporations)

- October 15, 2025 (for C-corporations)

If you’ve missed your initial deadline and haven’t filed a return or an extension, you may already be incurring penalties. Filing a business tax extension 2025 as soon as possible is your best bet to minimize the damage.

How to File a Business Tax Extension 2025

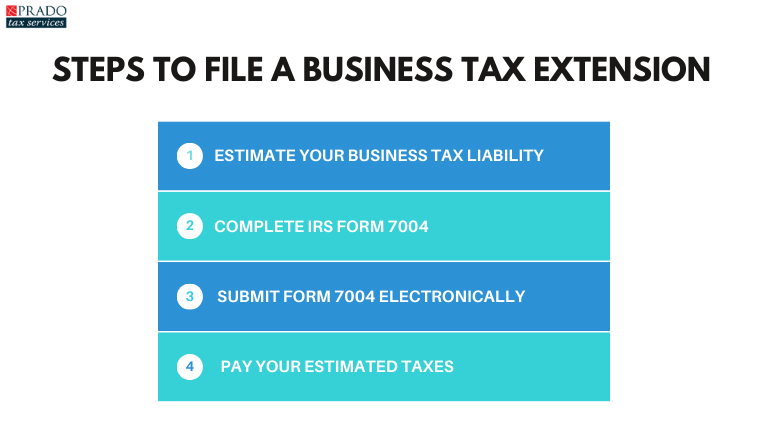

To file a business tax extension 2025, follow these steps:

1. Estimate Your Business Tax Liability

Even if you haven’t completed your bookkeeping or finalized your numbers, you must estimate your business tax liability. Use your prior year’s return, profit and loss statements, or consult a tax professional for help.

2. Complete IRS Form 7004

Form 7004 is used to request an automatic extension of time to file certain business income tax, information, and other returns. It applies to:

- S-Corporations (Form 1120S)

- C-Corporations (Form 1120)

- Partnerships (Form 1065)

- Trusts and Estates (Form 1041)

Be sure to include your estimated business tax payment amount on the form.

3. Submit Form 7004 Electronically or by Mail

You can file Form 7004 electronically through an IRS-authorized e-file provider or mail a paper copy to the IRS. Filing electronically is faster and provides instant confirmation of submission.

4. Pay Your Estimated Taxes by the Original Tax Deadline

Even with a tax extension 2025, payment is still due by March 17 or April 15, depending on your business type. Missing your business tax payment deadline can trigger interest charges and late payment penalties.

State vs. Federal Business Tax Extensions

Many business owners assume a federal business tax extension automatically applies to their state taxes, but that’s not always true.

In California, the Franchise Tax Board (FTB) generally provides an automatic extension to file business tax returns. However, this extension does not give you extra time to pay. If your business tax liability is unpaid by the tax deadline 2025, you may still face penalties and interest.

If you’re doing business in multiple states, it’s essential to check each state’s extension rules, as they can vary significantly.

Related article: State vs. Federal Tax Deadlines 2025: What Business Owners Need to Know

What Happens If You Don’t File or Pay?

Failing to file your business tax return or pay your estimated taxes on time can result in several consequences:

- Late-filing penalty: Typically 5% of unpaid tax per month (up to 25%)

- Late-payment penalty: 0.5% of unpaid tax per month

- Interest on unpaid taxes: Accrues daily based on current federal interest rates

By filing a business tax extension 2025, you can avoid the steepest penalty, the late-filing penalty, and gain extra time to accurately submit your return.

Common Mistakes to Avoid

When dealing with a missed tax deadline 2025, avoid these costly missteps:

- Ignoring the payment obligation: The extension applies to filing, not paying.

- Guessing too low on estimated taxes: Underpayment can trigger penalties.

- Submitting Form 7004 late: The IRS won’t approve an extension after the deadline has passed.

- Assuming state taxes are covered: Always check local requirements.

Why Filing a Business Tax Extension Is Beneficial?

A business tax extension 2025 provides more than just peace of mind:

- Time to gather documentation: Especially useful for businesses with complex operations or pending financial data.

- Opportunity to review deductions: Maximize your credits and lower your business tax bill.

- Avoid hasty errors: Rushed filings can lead to mistakes that trigger audits or missed refunds.

- Work with a pro: Extensions give tax professionals time to strategize your return effectively.

How Prado Tax Services Can Help?

Filing a business tax extension can be confusing, especially under time pressure. At Prado Tax Services, we guide San Leandro business owners through every step of the process. From S-Corp filings to C-Corp payments, our team handles all aspects of business tax preparation and extension filing.

Contact us today to file your business tax extension quickly and ensure estimated payments are accurate. Whether you missed the tax deadline in 2025 or want help staying ahead of future ones, our professionals are here to support you with dependable and affordable services.