Introduction

Freelancers and self-employed professionals enjoy the flexibility of working on their own terms, but tax season can be a major challenge. Unlike traditional employees who have taxes automatically deducted from their paychecks, freelancers must track their income, manage deductions, and ensure they pay the right amount in self-employment taxes. This can be overwhelming, especially for those unfamiliar with individual tax filing for freelancers.

One of the biggest hurdles is staying compliant with IRS regulations. Self-employed individuals must calculate and pay estimated taxes throughout the year, report all income accurately, and maximize deductions to reduce their tax burden. Many freelancers struggle with tax preparation because they lack proper guidance. This is where small business tax assistance services play a crucial role by helping freelancers stay compliant and minimize tax liability.

With the April 15 tax deadline approaching, it’s crucial for freelancers to file their taxes correctly and on time. Seeking individual tax filing assistance from a professional can simplify the process, ensuring compliance while maximizing tax savings. Whether you need small business tax assistance or expert guidance, a professional can help you avoid common tax mistakes and reduce financial stress.

What are the Essential Tax Deductions for Freelancers?

One of the biggest advantages of being self-employed is the ability to claim tax deductions on business-related expenses. These deductions help lower your taxable income, reducing the amount you owe in self-employment taxes. However, understanding which expenses qualify and how to report them correctly is key to maximizing savings.

1. Home Office Deduction

If you use a portion of your home exclusively for business, you may qualify for a home office deduction. This allows you to deduct expenses such as rent, utilities, and maintenance costs based on the percentage of your home used for work. The IRS offers two calculation methods:

- Simplified Method – Deduct $5 per square foot of office space, up to 300 square feet.

- Actual Expense Method – Deduct a percentage of home expenses based on the size of your workspace.

For freelancers working remotely, this deduction can lead to significant tax savings. Professional small business tax assistance services can help determine which method works best for you.

2. Business Expenses

Freelancers often invest in tools and services to manage their business. The following expenses are fully deductible:

- Software and subscriptions – Accounting tools, design software, and other work-related applications.

- Office equipment – Laptops, printers, and office furniture.

- Internet and phone bills – A portion of these expenses can be deducted if used for business.

- Marketing and advertising – Website hosting, social media ads, and promotional materials.

To ensure you don’t miss out on valuable deductions, consider using individual tax filing services that specialize in tax filing for freelancers.

3. Travel, Meals, and Vehicle Expenses

Freelancers who travel for work can deduct a variety of related expenses, including:

- Transportation – Airfare, train tickets, or car rentals.

- Lodging – Hotel stays during business trips.

- Meals – 50% of business-related meals are deductible.

- Vehicle expenses – If you use your car for business, you can either:

- Deduct mileage at the standard IRS rate.

- Deduct actual expenses (gas, maintenance, insurance).

Tracking these expenses properly is essential for accurate individual tax filing. Working with a small business tax assistance provider ensures that all deductions are correctly applied, reducing your overall tax burden.

Estimated Quarterly Taxes: What You Need to Know

Unlike traditional employees who have taxes withheld from their paychecks, freelancers and self-employed professionals are responsible for paying their own taxes. The IRS requires them to make estimated quarterly tax payments throughout the year to cover income tax and self-employment taxes (Social Security and Medicare). Failure to do so can result in penalties and interest charges. Understanding how estimated taxes work is essential for avoiding surprises at tax time.

Why Self-Employed Individuals Must Pay Estimated Taxes?

The U.S. tax system operates on a “pay-as-you-go” basis, meaning taxes must be paid as income is earned. Since freelancers don’t have an employer withholding taxes, they must estimate their tax liability and make payments every quarter. This ensures they stay compliant and avoid a large tax bill at the end of the year.

How to Calculate and Pay Quarterly Taxes?

To estimate quarterly taxes, freelancers need to calculate their expected annual income, deductions, and tax liability. Here’s a simplified method:

- Estimate your taxable income – Total earnings minus deductible expenses.

- Calculate self-employment tax – 15.3% (12.4% for Social Security + 2.9% for Medicare).

- Determine income tax – Based on your tax bracket and filing status.

- Divide by four – To determine the amount due each quarter.

The IRS provides Form 1040-ES, which includes worksheets to help with these calculations. Seeking small business tax assistance can simplify the process and ensure accurate payments.

Penalties for Missing Estimated Tax Payments

Missing or underpaying estimated taxes can result in IRS penalties and interest charges. The penalties are calculated based on:

- The amount of underpayment.

- The length of time the tax remains unpaid.

- The IRS interest rate (which changes quarterly).

To avoid penalties, freelancers should:

- Keep track of their income and set aside a portion for taxes.

- Make quarterly payments on time.

- Use individual tax filing services to ensure accurate tax calculations.

By staying on top of estimated tax payments, freelancers can avoid unnecessary penalties and keep their finances in order. For expert guidance, individual tax filing assistance from a tax professional can be invaluable.

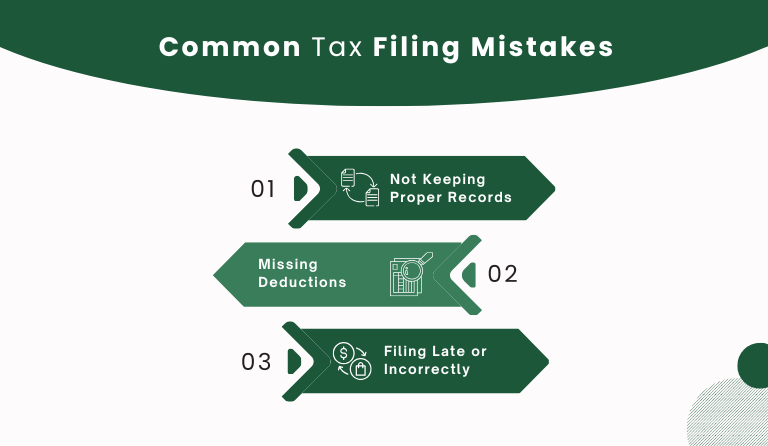

Common Tax Filing Mistakes & How to Avoid Them

Freelancers and self-employed professionals often make tax mistakes that can lead to audits, penalties, or missed deductions. Here’s how to avoid them:

Poor Record-Keeping – Use accounting software and keep receipts to track income and expenses for accurate individual tax filing.

Missing Deductions – Many freelancers overlook home office expenses, travel costs, and software purchases. Small business tax assistance experts can help maximize deductions and reduce tax burdens.

Late or Incorrect Filing – Missing the April 15 deadline can result in penalties. Set reminders and use individual tax filing services to ensure accuracy.

Underpaying Estimated Taxes – Freelancers must make quarterly tax payments. Working with a small business tax assistance provider ensures compliance and prevents penalties.

By addressing these mistakes, self-employed professionals can streamline individual tax filing and avoid unnecessary financial stress. Seeking expert small business tax assistance makes the process hassle-free while maximizing savings.

How Professional Tax Services Can Help

Benefits of Using Local Tax Professionals

Hiring a small business tax assistance expert offers personalized service and industry expertise. Key advantages include:

- Accurate business & individual tax filing: Avoid costly errors and IRS audits.

- Maximized deductions: Ensure you claim every eligible expense.

- Time-saving: Reduce stress by letting experts handle complex tax calculations.

- Tax planning strategies: Get insights on minimizing future tax liability.

Affordable Tax Services for Freelancers

Many freelancers hesitate to hire a tax professional due to cost concerns. However, investing in small business tax assistance can actually save money in the long run by preventing penalties and maximizing deductions.

How to Choose the Right Tax Advisory Service?

Selecting the right tax professional is essential for reliable individual tax filing. Here’s what to consider:

- Experience – Look for specialists in small business tax assistance.

- Reputation – Read reviews and testimonials from other freelancers.

- Certifications – Ensure they are certified tax preparers or CPAs.

- Range of Services – From individual tax filing help to audit assistance, choose a service that meets your needs.

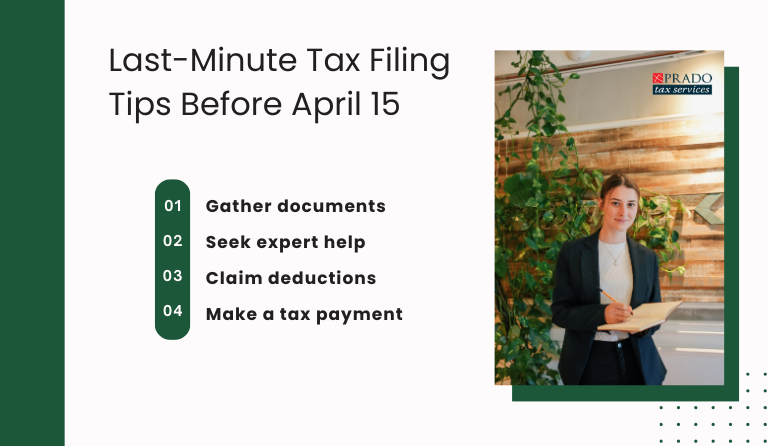

Last-Minute Tax Filing Tips Before April 15

With the April 15 tax deadline fast approaching, freelancers and self-employed professionals must act quickly to avoid penalties. Here’s what you need to do:

- Gather documents: Ensure you have 1099 forms, expense records, and receipts ready.

- Seek expert help: Using small business tax assistance like Prado Tax Services can streamline the process.

- Claim deductions: Maximize savings by deducting home office expenses, business tools, and travel costs.

- Make a tax payment: Pay what you owe by April 15 to avoid penalties.

How to File an Extension If Necessary

If you need more time, you can file for an extension using IRS Form 4868, which grants an additional six months (until October 15) to file your return. To file an extension, you can:

- Submit Form 4868 electronically through IRS Free File.

- Use Prado Tax Services’ tax return services to handle the extension process efficiently.

IRS Resources for Self-Employed Tax Filers

The IRS offers several resources to assist freelancers and small business owners with tax filing, including:

- IRS Free File – Online tax preparation software for those who qualify.

- Taxpayer Assistance Centers – Local offices that provide in-person support.

- IRS Direct Pay – A secure way to pay estimated and final tax payments.

- Self-Employed Tax Center – A hub with important tax information for freelancers & individual tax filing.

However, navigating these resources can be complex. Working with a small business tax assistance provider like Prado Tax Services ensures you get expert guidance tailored to your needs.

Conclusion

Filing taxes as a freelancer doesn’t have to be overwhelming. By understanding self-employment taxes, keeping accurate records, and making estimated quarterly tax payments, you can avoid penalties and maximize deductions.

Let Prado Tax Services handle your individual tax filing with precision and expertise. Whether you need small business tax assistance, guidance on income tax filing, or professional tax return services, our experts ensure a stress-free experience. Contact us today for expert tax assistance and to maximize your deductions.