Read Our Blog and Stay Informed

Tax Preparation Tips

Tax laws are constantly changing and people are often unaware of import changes that may impact their finances. For this reason, we've started a blog to share important information, best practices and expertise to keep you always informed. So, browse though our blog content freely for useful insights, news and tips centered around tax preparation and accounting from our team here at Prado Tax Services.

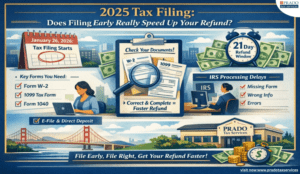

2025 Tax Filing Start Date: Does Filing Early Really Speed Up Your IRS Tax Refund?

Tax season is here, and for most people, the first thing on their mind is a refund. The goal is to receive it quickly, ensure

California Restaurant Tax Filing Essentials: What to File, When to File, and Why It Matters

Running a restaurant in California means taxes are always part of the picture, even when the focus is on food, staff, and customers. Sales happen

How to prepare for tax filing in 2026 as a California taxpayer

Tax filing in 2026 doesn’t have to feel like a last-minute scramble. Smart tax preparation starts well before you actually submit anything, and that’s where

Preparing to file with W-2s and 1099s? What California taxpayers should review

As W-2s and 1099s start arriving ahead of the tax filing season, California taxpayers should take time to review these forms before submitting a return.

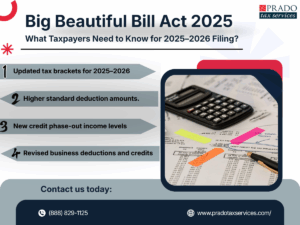

Big beautiful bill act 2025: what taxpayers need to know about filing in 2025–2026 | Updated tax rules overview

Before you start your 2025 and 2026 income tax filing, the Big Beautiful Bill Act 2025 has already shifted the ground under your feet. Some

IRS $2,000 Child Tax Credit Explained (2025): Eligibility, Refund Amount & Monthly Payment Updates

The IRS kept the Child Tax Credit at $2,000 for 2025, and that amount still makes a real difference for families. One small detail can