Tax filing in 2026 doesn’t have to feel like a last-minute scramble. Smart tax preparation starts well before you actually submit anything, and that’s where most people get it wrong. They wait until forms start showing up, then panic when something’s missing or doesn’t match what they expected.

Getting your documents together early means more than just stacking papers in a folder. It’s about verifying that your W-2 forms for employers accurately reflect your actual earnings, confirming that every 1099 form reporting non-employee income matches the income you received, and ensuring that your personal details haven’t changed since last year. Tax agencies cross-check what you report against what they already have on file. When numbers don’t line up, processing slows down.

Whether you earn wages from a single job, run a side business, or juggle multiple income streams, the filing of your tax return in 2026 will go smoothly if you prepare now. Taking the time to organize records and understand what tax filing actually requires can save you from errors, missed deductions, and unnecessary stress as deadlines approach.

Nobody enjoys tax season, but if you know what to expect and handle the prep work before it’s urgent, the whole process becomes more predictable and less frustrating.

Why getting organized before tax filing makes all the difference

Tax preparation isn’t about filling out forms. That part’s straightforward once you have everything in front of you. The challenge is making sure the information you’re working with is complete and accurate before you start, and most people don’t realize that until they’re already halfway through the process.

Starting early gives you time to catch gaps. You can request missing documents, compare what you have against what you expect, and fix small problems before they turn into bigger issues. If you’re planning to work with Bay Area tax services, getting organized early means they can focus on optimizing your return instead of scrambling to meet deadlines.

The IRS and California’s Franchise Tax Board compare your income tax return against data they already received from employers and financial institutions. When there’s a mismatch, your return gets flagged. Sometimes it’s resolved quickly, but other times it delays your refund or triggers follow-up questions that could have been avoided with better preparation upfront.

People who wait until the deadline often discover they’re missing a form or forgot about income from months ago. By then, tracking things down becomes stressful and time-sensitive. Understanding how to file taxes correctly from the start prevents these common problems.

The earlier you start working on tax filing, the smoother the filing of the tax return becomes.

Gathering income documents and understanding what gets reported

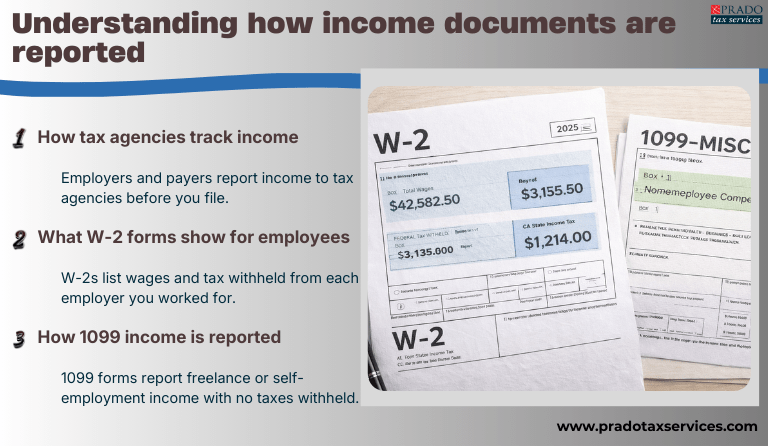

Understanding how your income documents are reported before tax filing begins is one of the simplest ways to avoid delays and keep your return processing smooth. Every year, employers and payers send copies of your tax forms to the IRS and state agencies before they send them to you. That means by the time you’re ready to file, the government already knows what income you should be reporting.

Most wage earners receive W-2 forms from employers by late January. These forms show your total earnings, taxes withheld, and other payroll details. If you had multiple jobs during 2025, you’ll get a separate W-2 from each employer. Self-employed workers, freelancers, and contractors typically receive Form 1099-MISC or other 1099 variants reporting non-employee compensation.

It’s easy to overlook how one missing form or a small reporting error can quietly change the outcome of a tax return. Maybe you did some side work in March and forgot about it by December. Maybe a client paid you through a platform that issues 1099s, but you never received yours. The IRS got a copy, though, and when your income tax return doesn’t include that payment, it raises questions.

Gathering all your income documents before you start the process of how to file taxes gives you a clear picture of what needs to be reported. If something seems off or if you’re expecting a form that hasn’t arrived, you have time to follow up and get it sorted before the filing of the tax return deadline hits. Many taxpayers find that working with Bay Area tax professionals helps them identify missing documents early in the tax preparation process.

What to check on your W-2 before you file

Your W-2 forms for employers are the backbone of most people’s tax filing, but a lot of folks don’t actually check them carefully until something goes wrong. Each W-2 breaks down your wages, federal income tax withheld, Social Security and Medicare taxes, and state withholding. Box 1 shows your total taxable wages. Box 2 shows what your employer already sent to the IRS on your behalf. If you had multiple jobs in 2025, you’ll get a W-2 from each one, and all of them need to be reported when you complete your tax filing.

Employers sometimes make mistakes. A typo in your Social Security number, an incorrect address, or wages reported in the wrong box can all cause problems down the line. If your W-2 looks off, contact your employer right away. They’re required to issue a corrected form if there’s an error, but that takes time, which is why you don’t want to wait until April to notice. Proper tax preparation means catching these errors before you submit your income tax return.

California employers also report state wages and withholding on the same W-2, usually in boxes 15 through 17. Make sure those numbers are there, because you’ll need them when filing your state return. Missing or incorrect state information can delay your California refund even if your federal return processes fine.

If you worked for a San Francisco tax services firm, a tech company using Bay Area tax services, or any employer in San Leandro, your W-2 should arrive by January 31. If it doesn’t show up, reach out to your employer first. If that doesn’t work, the IRS has a process for how to file taxes without it, but it’s better to get the actual form if you can.

Taking time to review W-2 forms for employers now means fewer headaches when tax preparation kicks into full gear. If you need help understanding your W-2 or verifying that the information is correct, our personal tax services can help you review your documents even before you begin filing your tax return at Prado Tax Services.

Understanding Form 1099-MISC and other 1099 variants

Form 1099-MISC is one of several 1099 forms used to report certain types of income paid during the year. If you received $600 or more from a client or business for work you did outside of a W-2 employment arrangement, you should expect to receive this form by January 31st. Understanding Form 1099-MISC is critical when learning how to file taxes as a freelancer or contractor.

Box 1 on Form 1099-MISC shows non-employee compensation, which is what most freelancers and contractors will see. This income gets reported on Schedule C when you file your income tax return, and you’ll also need to pay self-employment tax on it. That’s the part people forget about sometimes during tax preparation. It’s not just income tax; it’s also the Social Security and Medicare taxes that an employer would normally cover for a W-2 employee.

Common 1099 forms California taxpayers receive

There are more than a dozen types of 1099 forms, but most California taxpayers will only deal with a few. Here’s what each one reports:

Form Type | What It Reports | Who Receives It |

1099-NEC | Non-employee compensation | Freelancers, contractors, independent workers |

1099-MISC | Rent, royalties, other income | Property managers, artists, and various recipients |

1099-INT | Interest income | Anyone earning $10+ in bank interest |

1099-DIV | Dividend and capital gains | Investors with stocks, mutual funds |

1099-K | Payment card transactions | Online sellers, gig workers using payment platforms |

People forget about 1099s during tax filing. Or they assume a small payment doesn’t matter. Or they never received the form in the mail because they moved. But the IRS still has a record of it, and when your return doesn’t include that income, you’ll get a notice months later asking why. Knowing how to file taxes with multiple Form 1099-MISC documents helps avoid these notices.

You can download these forms from https://pradotaxservices.com/frequently-used-tax-forms/ or from the IRS website https://www.irs.gov/forms-instructions.

Reviewing last year’s return for changes that affect 2026

Checking last year’s filing of tax return before you start working on 2026 helps you spot changes that might impact how you file this year. Personal details like your address, filing status, or dependents directly affect your standard deduction, tax credits, and which forms you need for tax filing.

Common life changes and their tax impacts

Small changes in your life can have big effects on your return during tax preparation. Here’s how major events affect your tax filing:

Life Change | Tax Impact | What You Need to Know |

Got married or divorced | Changes filing status and tax bracket | Affects deductions and credits you qualify for |

Had or adopted a child | Adds dependent, changes credits | May qualify for Child Tax Credit, different filing status |

Bought a house | Opens itemized deductions | Can deduct mortgage interest and property taxes |

Started a business or freelancing | Changes in income reporting | Need Schedule C, pay self-employment tax |

Moved to a new address | Updates state filing requirements | May need part-year resident returns if crossing state lines |

Last year’s income tax return also shows what you claimed for deductions and credits. If you took the standard deduction last year but think you might have enough expenses to itemize this year, you’ll need to track those receipts and documentation carefully. Understanding how to file taxes with itemized deductions requires more preparation than taking the standard deduction.

Some people assume tax filing works the same way every year, but reviewing what you filed last year gives you a baseline and helps you understand what’s different this time around during tax preparation.

California-specific considerations when preparing for tax filing

California taxpayers must file both federal and state returns, and the rules don’t always align. Some deductions or income treatments allowed on a federal return may not apply at the state level.

State vs. federal Income differences

California taxes certain income differently than the IRS. For example, unemployment benefits are taxable on a federal return but not on a California return. Both the IRS and California Franchise Tax Board (FTB) receive copies of W-2 forms for employers and information returns such as Form 1099-MISC, and they cross-check them against what’s reported on your returns. For a more detailed comparison of federal vs. state rules, see our guide on state vs. federal tax differences.

Capital gains and tax brackets on selling gold

When you sell gold jewelry, coins, or bullion for a profit, the IRS treats these assets as collectibles for tax purposes. This classification affects how capital gains from selling gold are taxed at the federal level.

Federal tax treatment (IRS)

- Short-term capital gains

If you held the gold for one year or less, any profit is taxed as ordinary income, based on your regular federal income tax bracket.

- Long-term capital gains (collectibles rate)

If you held the gold for more than one year, the gain is taxed as a collectibles long-term capital gain, with a maximum federal tax rate of 28%.

This rate is higher than the standard long-term capital gains rates (0%, 15%, or 20%) that apply to most stocks and mutual funds.

According to the IRS, precious metals such as gold fall under the collectibles category for capital gains reporting.

Reporting requirements

Profits from selling gold are reported on Form 8949 and Schedule D as part of your income tax return. In some cases, dealers may report qualifying transactions to the IRS on Form 1099-B, meaning the IRS may already have a record of the sale.

California tax treatment

California does not provide a special capital gains rate for collectibles. Gains from selling gold are generally taxed as ordinary income on your California return, which can result in a different tax outcome compared to your federal return.

Estimated tax payments for investments

If you’re self-employed, have significant investment income from sources like taxes on selling gold or stock sales, or owe more than a certain amount in state taxes, you might need to make quarterly estimated payments to avoid penalties. Learning how to file taxes with estimated payments is essential for anyone with substantial income from selling gold or other investments.

Part-year residency complications

If you moved to or from California during 2025, you’ll need to file a part-year resident return, which can get complicated depending on where capital gains from taxes on selling gold or other assets were earned during your residency. Working with tax prep san francisco professionals can save you time and help you avoid mistakes during the filing of tax return, especially with complex situations like taxes on selling gold or part-year residency.

Organizing deductions and keeping records that matter

Most California taxpayers take the standard deduction because it’s simpler and often results in a bigger deduction than itemizing during tax filing. But if you had significant medical expenses, mortgage interest, charitable donations, or other deductible expenses, itemizing might save you money. The key is having the documentation to back up what you claim on your income tax return.

Medical and housing deductions

Medical expenses are deductible if they exceed a certain percentage of your adjusted gross income, including doctor visits, prescriptions, and insurance premiums. Mortgage interest and property taxes are still deductible during tax filing, though there are caps on how much you can claim. Your lender will send you a Form 1098 showing how much interest you paid during the year.

Business expense tracking

If you’re self-employed or run a business, keeping track of expenses throughout the year makes tax preparation much easier. Business mileage, office supplies, and software subscriptions can all be deducted, but you need documentation. The IRS can audit returns going back several years, so don’t rely on memory when preparing your income tax return.

Simple record-keeping systems

Good record-keeping doesn’t mean you need a fancy system. A folder with receipts, bank statements, and tax forms works fine for most people learning how to file taxes. If you wait until tax season to organize everything, you’ll probably miss something that could have reduced your tax bill.

When professional help makes sense for tax preparation

Most people can handle a straightforward income tax return on their own, especially if they only have one W-2 and maybe some interest income. But once your situation gets more complex, working with professionals starts to make more sense than trying to figure out how to file taxes yourself.

You should consider getting help with tax filing if you have multiple income sources. W-2 from a full-time job, Form 1099-MISC from freelance work, rental income, investment earnings, or side gig payments all add up to a more complex return. Each type of income gets reported differently during tax preparation, and missing something can create problems with the IRS later.

If you’re self-employed or run a small business, professionals who specialize in business taxes know how to handle deductions for expenses, mileage, and quarterly estimated tax payments that are required throughout the year as part of proper tax filing. Major life changes like getting married, buying a house, having a baby, or starting a new business are also reasons to get help with tax preparation, since these events affect your taxes differently, and professionals can help you avoid missing deductions during the filing of your tax return. Tax software works for straightforward situations, but professionals can look at your whole financial picture and catch things you might not mention when figuring out how to file taxes.

If you’re in the Bay Area and need help navigating tax filing with complex income situations, Prado Tax Services offers both personal and business tax preparation with professionals who understand California’s specific requirements. Whether you’re dealing with multiple W-2 forms for employers, several Form 1099-MISC documents, or a combination of income types, having someone review your income tax return before filing can prevent costly mistakes. You can also review Prado Tax Services’ guide on preparing with W-2s and 1099s for additional insight.

California tax deadlines and what happens if you need more time

The IRS sets April 15 as the standard deadline for filing individual income tax returns each year, unless the date falls on a weekend or federal holiday, in which case the deadline shifts to the next business day. For the 2025 tax year, the federal tax filing deadline is April 15, 2026, and California generally follows the same deadline for state returns. The IRS publishes official guidance on when to file your taxes to help taxpayers confirm current filing dates.

If you’re not ready to complete tax filing by the April deadline, you can request an extension from the IRS. An approved extension allows you until October 15, 2026, to submit your return, but it does not extend the time to pay any taxes owed. Any estimated tax due must still be paid by the original April deadline to avoid penalties and interest. The IRS also provides step-by-step instructions on how to file your taxes, including information on extensions and payment options.

Getting an extension approved

Extensions are automatic if you file the right form during tax preparation. For federal returns, that’s Form 4868. California has its own extension form, but if you file a federal extension, California typically grants one automatically. This gives you more time for the filing of your tax return without penalties for late filing.

What happens if you miss the deadline

Missing the deadline without filing an extension can result in penalties during tax filing. The IRS charges a failure-to-file penalty that’s usually much higher than the failure-to-pay penalty, so even if you can’t pay what you owe, filing your income tax return on time or requesting an extension helps minimize the financial hit.

If you’re working with tax prep San Francisco professionals or tax services San Leandro firms, they can help you decide whether an extension makes sense for your situation during tax preparation. Sometimes it’s better to complete tax filing on time even if you’re not 100% certain everything’s perfect, especially if you’re expecting a refund.

Common mistakes California taxpayers make when preparing returns

Tax filing mistakes happen more often than most people realize, and many of them are completely avoidable with a little extra attention during tax preparation. Understanding these common problems before you submit your income tax return helps you catch issues early and avoid delays or complications.

Here are the most frequent mistakes to watch for:

- Not reporting all income: If you received a Form 1099-MISC or any other 1099 variant, that income needs to be reported, even if you didn’t get the actual form in the mail. The IRS has a copy, and they will notice if it’s missing from your income tax return.

- Mixing up filing status: Single, married filing jointly, married filing separately, head of household, and qualifying widow(er) all have different rules and tax rates. Choosing the wrong status can cost you money or trigger an audit when you completeyour tax filing.

- Math errors on returns: Double-check your calculations during tax preparation, and if you’re using software, review the final numbers before submitting. The IRS will catch math errors and correct them, but that can delay your refund.

- Forgetting signatures or wrong bank details: Electronic signatures are required for e-filed returns, and if you’re filing by mail, both spouses need to sign if you’re married filing jointly. Wrong bank account information causes big delays during tax filing.

- Not keeping copies of your return: You should keep tax records for at least three years in case the IRS or California’s Franchise Tax Board has questions about your income tax return.

Taking time to review these errors before you submit the filing of your tax return can save you weeks of correspondence with tax agencies. Understanding how to file taxes properly includes these basic but critical steps.

Planning and tracking your refund

Once you complete tax filing, you can track your federal refund through the IRS’s “Where’s My Refund?” tool on their website. California taxpayers can check their state refund status through the Franchise Tax Board’s website. Most refunds are issued within 21 days if you filed electronically and chose direct deposit.

If your refund from tax filing is taking longer than expected, the IRS or state may have flagged your income tax return for additional review. Common reasons for delays include errors on the return, missing information, or claims for certain credits that require extra verification during tax preparation.

According to the IRS, taxpayers who set up payment plans in advance generally face lower penalties than those who wait for collection action to begin. If you know you’re going to owe after tax filing and can’t pay, reach out before the deadline to discuss your options.

Tax preparation doesn’t end when you file your return. The choices you make throughout 2026 will affect the filing of your tax return in 2027. Review your withholding if you’re a W-2 employee. Keep better records throughout the year. Consider tax-advantaged accounts like IRAs or HSAs that can lower your taxable income during next year’s tax filing.

If your financial situation is getting more complex, plan to work with professionals before next tax season arrives. Understanding how to file taxes efficiently doesn’t have to be stressful every year. With better planning and organization, the process becomes manageable. For additional guidance on recent tax law changes, Prado Tax Services has outlined key updates related to read about the Big Beautiful Bill Act 2025.

Conclusion

Preparing for tax filing in 2026 as a California taxpayer comes down to organization, accuracy, and starting early enough to handle problems before they become urgent. Whether you’re gathering W-2 forms for employers, tracking down Form 1099-MISC documents, or figuring out how to file taxes with a more complex situation than last year, the key is giving yourself time to do it right.

Review your documents carefully during tax preparation, check for errors, and follow up on anything missing or incorrect. Understand what’s different this year compared to last, and know when it makes sense to get professional help. California taxpayers deal with both state and federal requirements, so keeping both returns accurate and consistent matters during the filing of the tax return.

If you’re looking for support with your income tax return or need guidance on tax preparation strategies that fit your specific situation, we at Prado Tax Services in San Leandro can help. Their team understands California tax law and can review your documents, answer questions, and make sure everything’s filed correctly before the deadline. Whether you’re handling a straightforward return or dealing with multiple income sources, working with professionals who know the details can make the difference between a smooth filing experience and months of back-and-forth with tax agencies.

Tax season is coming. Start preparing now, and you’ll file with confidence when the time comes.