Most people file their taxes with one primary expectation: receiving their IRS tax refund within a reasonable timeframe. Once a return is submitted, it’s common to assume the remaining steps will happen automatically.

When weeks pass without an update, taxpayers often begin checking their refund status and questioning what may have changed. In many cases, the delay is not related to when the return was filed.

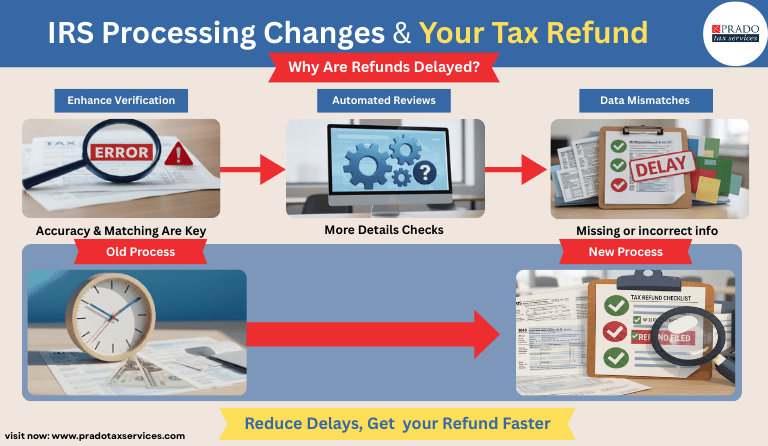

Behind the scenes, the way returns move through the IRS has shifted. Processing systems are now more digital, more detailed, and less forgiving of small gaps or mismatches. As a result, IRS tax refunds are tied just as closely to accuracy and verification as they are to timing.

Understanding how the IRS processes refunds helps taxpayers plan better and reduce IRS Tax refund delays.

Many taxpayers assume that filing quickly guarantees a faster refund, without realizing that updated IRS processing systems place greater emphasis on accuracy, verification, and complete reporting.

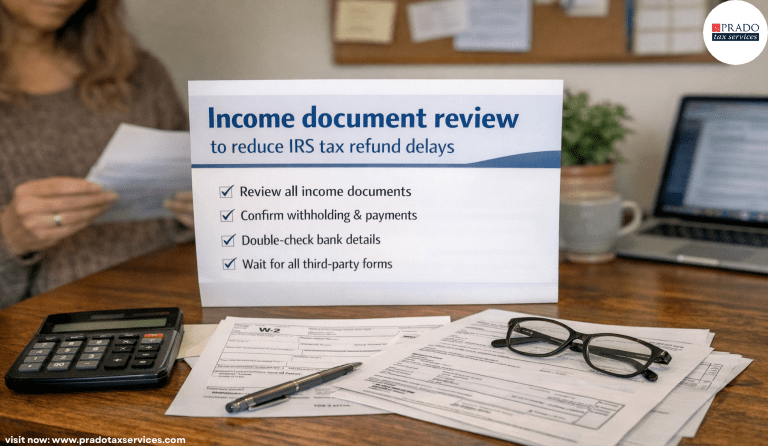

Reviewing income documents, withholding information, and refund details before filing improves accuracy and ensures returns align with current IRS processing requirements. This same preparation approach is explained in our guide on how to prepare for tax filing and is a core part of effective personal tax preparation when avoiding IRS tax refund delays.

And yes, that extra review step can feel annoying.

It often makes the difference between a smooth payout and weeks of waiting.

If your IRS tax refund feels slower than expected, it usually isn’t random. There’s a reason. And once you understand how the system works now, you can work with it instead of against it.

Why filing early no longer guarantees a faster refund

Many taxpayers still believe that submitting a return as early as possible leads to a faster IRS tax refund. That assumption made sense years ago, when processing relied more on timing and less on verification, but it no longer holds, as explained in our breakdown of filing early and refund timing. Today, the process works differently.

The Internal Revenue Service now places greater emphasis on matching and accuracy before releasing refunds. Income amounts, withholding, third-party reporting, and banking details are reviewed through automated systems before an IRS tax refund is approved.

This shift explains why an IRS refund delay update may appear even for taxpayers who filed early and electronically. Filing quickly is no longer enough on its own. Returns must also align closely with information reported by employers, financial institutions, and other sources.

When a return shows missing forms, mismatched income, or incomplete details, IRS processing slows. Even minor discrepancies can trigger IRS processing delays, moving the return out of the automated stream and into additional review.

This is often when taxpayers begin to notice an IRS late refund or hear concerns about IRS delays on refunds, more broadly. While it may feel unpredictable, these delays usually stem from verification checks rather than timing alone.

The current system is designed to pause when something does not match, rather than issue a refund that may later need correction. Understanding this change helps explain why filing early does not always result in faster payment and why accuracy now plays a much larger role in refund timing.

What actually changed inside the IRS processing

IRS tax refunds are now reviewed through a more layered process than many taxpayers expect. The change did not come from a single rule or announcement.

It came from gradual system updates that affect how returns are checked, matched, and approved before money is released. These changes are not always visible from the outside, but they play a direct role in why refund timing feels less predictable today.

Some of these updates are tied to the Big Beautiful Bill Act 2025 tax law changes, which continue to shape how the IRS evaluates and processes tax returns.

The IRS has confirmed this modernization through its announcement on the expanded Tax Pro Account for tax professional businesses, which reflects broader efforts to improve how tax data is accessed, verified, and processed.

Understanding what happens after a return is submitted helps explain why IRS tax refunds can pause, even when the filing seems correct and complete.

The shift toward automated verification

IRS tax refunds now move through a system that relies heavily on automated verification. When a return is submitted, the information reported is compared against data the Internal Revenue Service already has on file. This includes wages from employers, interest reported by banks, and income shared by payment platforms.

If the numbers match, the return continues through processing. When they do not, the system slows down. This is one of the main reasons IRS processing delays occur, even for taxpayers who filed electronically and on time.

Why matching matters more than timing

In the past, filing early often played a bigger role in determining when a refund arrived. That is no longer the case. Today, IRS tax refunds depend more on consistency across all reported information than on submission date alone.

When income tax return filing data does not align with third-party reports, the return is flagged for further review. This does not mean there is a problem, but it does mean the return will not move forward automatically. During this period, taxpayers may see notices related to IRS delayed processing or experience an unexpected pause in refund activity.

How small discrepancies trigger delays

Many IRS late refund situations begin with small issues. A missing form. A rounded number that does not match employer records. Income reported under the wrong category. These details may seem minor, but automated systems are built to pause when something does not fit expected patterns.

Once a return is flagged, the IRS tax refund is held until verification is complete. This is why the IRS’s delays in refunds have become a common concern even among taxpayers with otherwise simple returns.

Refund delivery details also play a role

Processing does not stop with income verification. Refund delivery details are reviewed as well. Incorrect banking information, closed accounts, or mismatched names can cause a tax refund delay even when the return itself has been accepted.

In these cases, the income tax return may be processed, but the IRS tax refund cannot be released until the payment method is confirmed or corrected. This often leads to confusion, especially when taxpayers believe everything was filed correctly.

What these changes mean in practice

The current system is designed to slow down rather than push money out when something does not match. Accuracy is prioritized over speed. As a result, IRS tax refunds now depend on careful preparation, complete reporting, and alignment across all data sources.

Understanding these internal processing changes helps explain why IRS processing delays are more common and why refund timing has become less predictable than it once was.

Why IRS tax refunds get delayed even when everything looks right

At this stage, many taxpayers feel stuck.

The return was submitted. The numbers looked fine. No obvious mistakes.

Yet the IRS tax refund does not arrive.

This usually happens because processing delays are triggered by factors that are not visible during filing. Below are the most common ones.

Third-party reporting has not been fully posted

IRS tax refunds rely on more than what taxpayers report. The Internal Revenue Service also compares returns against information it receives separately.

Common examples include:

- wages reported by employers

- interest and dividends reported by banks

- income shared by payment platforms and brokers

If those records are delayed or incomplete when income tax return filing begins, the return may pause until the data is fully posted. This often leads to IRS processing delays even when the filing itself was accurate.

Income totals match, but categories do not

A return can show the correct total income and still trigger a review.

This usually happens when:

- Income is reported under the wrong form type

- Business income is mixed with wage income

- Adjustments do not align with third-party records

In these cases, the IRS tax refund is not denied. It is held while the system confirms how the income should be categorized. This is a common reason for an IRS late refund that surprises taxpayers.

Withholding and payment records do not line up

Another frequent cause of tax refund delay involves withholding.

Examples include:

- Employer withholding is reported incorrectly

- estimated payments not fully credited

- payments applied to the wrong tax year

When withholding information does not match IRS records, the return may be flagged. This contributes to the IRS being late on refunds and often requires additional time to resolve.

Refund delivery details cause a pause

Even when income and withholding match, IRS tax refunds can still be delayed due to payment issues.

Common triggers include:

- incorrect bank account numbers

- closed or inactive accounts

- name mismatches on direct deposit information

In these cases, the filing of a tax return may be complete, but the refund cannot be released until delivery details are corrected. This often appears to taxpayers as IRS delayed processing.

System reviews triggered by patterns, not errors

Some delays occur even without mistakes.

Automated systems are designed to pause when returns fall outside expected patterns. This can include:

- unusually large refunds

- changes in income compared to prior years

- credits or deductions that require extra review

When this happens, IRS tax refunds are paused for verification, not rejection. Still, it results in IRS processing delays that feel unexplained from the outside.

How these delays usually show up

When one or more of the above issues occur, taxpayers often see messages such as:

- Your tax return is still being processed

- IRS return delayed

- IRS refunds are late

These messages indicate review, not failure. Most resolve without action, but they do extend refund timelines.

What taxpayers should do now to reduce IRS tax refund delays

IRS tax refunds are no longer just about when a return is submitted. They depend on how well the information in a return aligns with records already in the system. That means preparation before tax filing plays a much bigger role than it used to.

This section breaks down the practical steps taxpayers should take to reduce the risk of delays and help their IRS tax refund move through processing with fewer interruptions.

Review income documents before filing anything

Before income tax return filing begins, all income documents should be reviewed carefully. This includes more than just wages.

Taxpayers should confirm:

- Review all income documents before income tax return filing

- Confirm withholding and estimated payments

- Double-check bank and delivery details

- Avoid filing before all third-party data is available

Special attention is needed for W-2s and 1099s, especially for self-employed filers and those handling business tax preparation. Returns with multiple income sources or major year-to-year changes may benefit from a professional review, such as one provided by Prado Tax Services, to help identify issues before filing.

If even one document is missing or incorrect, the IRS tax refund may pause while the system waits for matching data. Filing without all income documents increases the chance of IRS delayed processing.

Confirm withholding and estimated payments are accurate

Withholding details plays a direct role in how refunds are calculated and released. Errors here are a common reason for tax refund delay.

Before filing a tax return, taxpayers should:

- Compare withholding on income forms to their own records

- Verify estimated payments were applied to the correct tax year

- Confirm payments were credited to the correct taxpayer

When withholding totals do not align with IRS records, the return may be flagged, leading to IRS late refund situations even when income numbers are correct.

Make sure the refund delivery information is current

Refund delivery errors are one of the most preventable causes of delay.

Taxpayers should double-check:

- bank account numbers

- account status, especially if an account was recently closed

- name matches between the return and bank records

An IRS tax refund cannot be released if delivery details fail verification. In these cases, the income tax return may be processed, but the refund remains pending until the issue is resolved.

Avoid filing before third-party data is available

One of the biggest reasons for an IRS refund delay update is timing around third-party reporting.

Employers, banks, and financial institutions submit information to the Internal Revenue Service on their own schedules. If tax filing happens before that data is fully available, the return may pause during verification.

Waiting until all expected documents have been received reduces the risk of IRS processing delays caused by missing third-party records.

Understand when a delay requires action and when it does not

Not every delay means something is wrong.

In many cases, messages such as: Your tax return is still being processed

- IRS return delayed

- IRS refunds that are late

indicate routine verification. These often resolve without action.

However, taxpayers should take action if:

- A notice requests additional information

- The refund status does not change for an extended period

- Payment details need correction

Knowing when to wait and when to respond helps prevent unnecessary follow-ups that can further slow IRS tax refunds.

Consider a professional review for complex returns

As IRS processing becomes more automated, small inconsistencies can trigger review more quickly than in the past.

Returns that involve:

- Multiple income sources

- Self-employment income

- Significant changes from prior years

may benefit from professional tax services. A careful review before filing can help identify issues that would otherwise lead to IRS delays on refunds or extended verification.

This does not mean every return requires assistance, but it does mean preparation matters more now than it once did.

Why preparation now affects refund timing later

The current system rewards consistency. Returns that match IRS records move faster. Returns that require clarification slow down.

Taking time before income tax return filing to confirm documents, payments, and delivery details gives IRS tax refunds the best chance to move through processing without interruption. This approach helps reduce frustration and lowers the risk of extended refund delays tied to IRS processing delays.

For taxpayers who want added confidence before filing, working with Prado Tax Services can provide an extra layer of review to help catch issues early.

Key points to understand when your return is still being processed

- Seeing “your tax return is still being processed” usually means the return was received but is still under review, not rejected.

- An IRS tax refund can pause while income, withholding, or payment details are verified against third-party records.

- Processing delays often come from automated checks, not manual review.

- Messages like your tax return is still being processed or the IRS return is delayed are common during routine verification.

- An IRS late refund becomes more likely when verification takes longer than standard processing time or when a notice is issued.

- Many concerns about IRS refunds being late stem from comparing current timelines to older filing seasons.

- Refund timing can vary even for returns filed on the same day due to differences in verification requirements.

- Most refund delays resolve without taxpayer action unless the IRS requests additional information.

- Repeated status checks or unnecessary follow-ups do not speed up IRS tax refunds and can sometimes slow resolution.

- Once verification is complete, IRS tax refunds typically move forward without further issues.

Where professional review fits into today’s IRS refund process

IRS tax refunds are now processed through systems that prioritize verification and data matching. Small inconsistencies in income reporting, withholding, or refund details can lead to IRS processing delays, even when a return is filed on time.

A professional review helps reduce these risks by confirming that information on a return aligns with IRS records before submission. This approach supports smoother income tax return filing and lowers the likelihood of an IRS late refund or extended IRS delayed processing.

Prado Tax Services focuses on accuracy and careful preparation rather than speed alone. Their tax preparation services are designed to align with current IRS processing requirements and reduce refund delays.

Bringing it all together

IRS tax refunds are no longer influenced by timing alone. Changes in IRS processing mean returns are reviewed more closely for accuracy, consistency, and alignment with third-party records before refunds are released.

Delays often occur when income, withholding, payments, or refund details do not match what the IRS has on file. In many cases, these pauses are part of routine verification rather than a sign of a problem. Understanding how the system works helps taxpayers set realistic expectations and avoid unnecessary concern.

Careful preparation remains the most effective way to reduce refund delays. Reviewing documents before filing, confirming payment and refund details, and filing only when all information is complete can help returns move through processing with fewer interruptions. If you have questions or want support reviewing your return before filing, you can reach out to us at Prado Tax Services for assistance.

As IRS systems continue to evolve, accuracy and preparation matter more than speed. Taxpayers who approach filing with that mindset are better positioned to receive their IRS tax refunds without extended delays.