As W-2s and 1099s start arriving ahead of the tax filing season, California taxpayers should take time to review these forms before submitting a return. These documents report wages, contract income, unemployment benefits, and other earnings that both the IRS and the state will match against what is filed. Missing forms, incorrect amounts, or income reported under the wrong category can lead to processing delays, refund holds, or notices later.

Whether you’re employed, self-employed, running a small business, or earning income from multiple sources, organizing and verifying your W-2s and 1099s before filing helps reduce errors, keeps state and federal reporting aligned, and allows you to file with greater confidence. A tax preparation service can help spot discrepancies early, but even if you’re handling things on your own through online tax filing, knowing what to look for makes a big difference. Let’s walk through what California taxpayers should review this season and why it matters more than most people realize.

Why do your W-2 and 1099 forms matter more than you think?

Smart tax filing when W-2s and 1099s start arriving means slowing down long enough to review each income form for accuracy and completeness before IRS filing begins. These documents are matched directly against what you report, and even one missing form or incorrect amount can delay a refund or result in an IRS notice later. Taking time to verify details upfront helps keep the filing process on track and reduces avoidable follow-up issues after submission.

Most people assume their employer or payer got everything right. And honestly, that’s usually true. But mistakes happen more often than you’d think. A wrong Social Security number, an extra zero in a box, income reported under the wrong classification, or a 1099 that never made it to your mailbox. Any of those can create a mismatch when the IRS runs its checks.

California taxpayers also need to think about state reporting. The Franchise Tax Board gets copies of the same forms, and they’re looking for consistency too. If your federal return shows one number and your state return shows another, that raises flags. Working with a personal tax preparer or using online tax filing software that pulls data directly from your forms can help catch these issues before they become problems. But even then, you’re the one who needs to confirm the information is correct. It’s your return, your refund, and your responsibility if something doesn’t line up. Many people find that professional tax services provide the extra layer of review needed to catch errors that automated systems might miss.

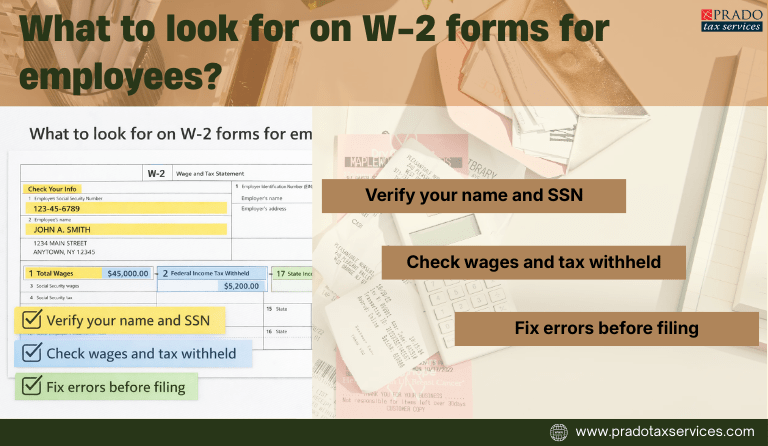

What to look for on W-2 forms for employees?

W-2 forms for employees report wages, tips, federal and state withholding, Social Security, Medicare, and other compensation paid during the tax year. Every employer who paid you $600 or more should send one by January 31st, and you need to verify the information matches what you actually earned and what was withheld from your paychecks throughout the year. Understanding W-2 forms for employees is the first step in accurate tax filing.

The basics you can’t skip

Start with your personal information at the top of the form. Check your name, Social Security number, and address. A typo in your SSN will cause the IRS system to reject your return immediately, and that means delays before you can even resubmit.

It sounds simple, but this is where a lot of rejections happen.

Then look at Box 1, which shows your total wages. Does it match your final pay stub from December? If you had pre-tax deductions like health insurance or retirement contributions, those will lower Box 1 compared to your gross pay, so don’t panic if the numbers aren’t identical. Just make sure the math makes sense based on what you know you earned. A personal tax preparer can help verify these calculations if you’re unsure about pre-tax adjustments.

Federal and state withholding boxes

Box 2 shows federal income tax withheld. Box 17 shows state income tax withheld. These are the amounts you’ll claim as payments already made when you file your return. If they’re wrong, you could end up owing more than expected or getting a smaller refund than you planned for. Cross-reference these with your pay stubs or your year-end payroll summary if your employer provides one.

Box 15 lists your state and your employer’s state ID number. Box 16 shows state wages, which usually match Box 1 but can differ in some cases depending on how your state handles certain deductions. California taxpayers should make sure Box 17 reflects what actually came out of their paychecks for state taxes throughout the year. Many tax preparation service providers emphasize the importance of double-checking withholding amounts before filing.

Multiple W-2s and what to watch for

If you worked multiple jobs or switched employers mid-year, you should receive separate W-2 forms for employees from each company. Don’t assume one employer reported everything or that income from a side job doesn’t count. Every W-2 matters, and the IRS will have copies of all of them.

This is where things get messy for people who freelance on the side or pick up gig work in addition to their main job. You might have W-2 forms for employees from your full-time employer and then a Form 1099-MISC or 1099-NEC from contract work. Both need to be reported, and mixing them up or leaving one out will create a mismatch when the IRS checks your return. A business tax preparer can help organize multiple income sources to make sure nothing gets missed.

What to do if something’s wrong

If you spot an error on your W-2, contact your employer’s payroll or HR department right away. They need to issue a corrected W-2 (called a W-2c) and send copies to you and the IRS. Don’t try to “fix” it yourself on your tax return by entering what you think the correct number should be. That will just trigger a notice later when the IRS compares what you filed against what your employer reported.

And if you’re missing a W-2 or spot an error, you’ll need to know how to get W-2 form corrections handled before the filing deadline hits. Waiting until the last minute makes this harder, so give yourself time to sort it out. A personal tax preparer can help you handle this if you’re not sure what steps to take or if your employer isn’t responding quickly. Understanding how to get W-2 form issues resolved is critical for timely filing.

Understanding 1099 forms and why they’re easy to miss?

1099 forms report income that didn’t come from a traditional employer. Freelance work, contract payments, investment earnings, rental income, unemployment benefits, state tax refunds, and even some side gig payments all get reported on different types of 1099s. The IRS gets copies of these, too, and they’re watching to make sure you report every dollar that shows up on a 1099 somewhere in your return.

People forget about them. Or they assume a small payment doesn’t matter. Or they never received the form in the mail because they moved or the payer had an old address. But the IRS still has a record of it, and when your return doesn’t include that income, you’ll get a notice months later asking why.

Why 1099s are harder to track than W-2s

W-2s come from your employer, so you know to expect them. 1099s can come from anyone who paid you $600 or more during the year, and that includes clients, platforms, banks, brokerages, your state government, or even a landlord if you’re a property manager. If you did freelance work for three different clients, picked up some gig work through an app, earned interest on a savings account, and received a state tax refund, you could have five or six different 1099s arriving from completely different sources.

They don’t all arrive at the same time, either. Some come in late January, others trickle in through mid-February. And if you moved or changed your address, some might not reach you at all. That’s why it’s smart to keep a list during the year of anyone who paid you outside of a regular paycheck. A business tax preparer or tax preparation service can help you track these if you’re running a small business or working multiple gigs, but even if you’re filing on your own through online tax filing, keeping notes helps.

What happens if you miss one

Let’s be real. Missing a 1099 is one of the easiest ways to end up with an IRS notice. The IRS matches what you report against the 1099s in their system, and if something’s missing, they’ll send you a letter asking for an explanation and possibly an amended return. That usually means you’ll owe more tax, plus interest, and maybe a penalty depending on how much was left off.

It’s not worth the headache. If you think you might have earned income that should have generated a 1099 but you haven’t received one yet, reach out to the payer and ask. You can also check your IRS account online later in the year to see what forms were filed under your Social Security number, though that information isn’t always available right away. Professional tax services often recommend keeping detailed records of all payment sources throughout the year to avoid missing forms.

How to get a W-2 form if yours is missing or incorrect

If it’s mid-February and you still haven’t received a W-2 from an employer, don’t just wait and hope it shows up. You need that form to file your return, and there are steps you can take to get it or work around the delay. Learning how to get W-2 form replacements is an important part of tax preparation.

Start by reaching out to your employer’s payroll or HR department. Sometimes W-2s get lost in the mail, sent to an old address, or stuck in processing. Ask them to reissue it or send it electronically if that’s an option. Most employers are willing to help once they know there’s an issue, and this is usually the fastest way to get your form. Give them a week or so to respond. If they’re not cooperating or you can’t reach them, that’s when you escalate.

What to do when your employer won’t respond

If your employer won’t send a W-2 or you can’t get through to anyone, you can contact the IRS directly. Call (800-829-1040) and let them know you’re missing a W-2. They’ll reach out to your employer on your behalf and request that the form be sent. The IRS takes this seriously because they need accurate reporting just as much as you do. Knowing how to get W-2 form assistance from the IRS can save you weeks of frustration.

You’ll need to provide the IRS with your employer’s name, address, phone number, and your dates of employment. It also helps to have an estimate of your wages and the amount withheld for federal taxes if you kept pay stubs throughout the year. A tax preparation service can help you organize this information and communicate with the IRS on your behalf.

Filing without a W-2 if you’re running out of time

If the filing deadline is approaching and you still don’t have your W-2, you can file using Form 4852 as a substitute.

This form lets you estimate your wages and withholding based on your final pay stub or other records. It’s not ideal because it can slow down your refund processing, but it allows you to file on time and avoid a late filing penalty. Here’s the catch, though. You’ll need to amend your return later once you get the actual W-2, especially if the numbers don’t match what you estimated. That means more paperwork and more waiting.

A personal tax preparer can help you decide if filing with Form 4852 makes sense or if it’s better to request an extension and wait for the real W-2 to arrive. If you’re using online tax filing software, some platforms will walk you through the Form 4852 process, but you’ll still need accurate records to make reasonable estimates. Don’t just guess. Use your last pay stub and calculate as closely as possible based on what you know. Understanding how to get W-2 form substitutes filed correctly can prevent complications during processing.

Form 1099-MISC and other common 1099 variants that California taxpayers receive

Form 1099-MISC reports payments made to independent contractors, freelancers, and other non-employees for services performed during the year. If you received $600 or more from a client or business for work you did outside of a W-2 employment arrangement, you should expect to receive this form by January 31st. Many taxpayers receive Form 1099-MISC for consulting work, side projects, or contract services.

Box 1 on Form 1099-MISC shows non-employee compensation, which is what most freelancers and contractors will see. This income gets reported on Schedule C when you file your tax return, and you’ll also need to pay self-employment tax on it. That’s the part people forget about sometimes. It’s not just income tax; it’s also the Social Security and Medicare taxes that an employer would normally cover for a W-2 employee. When you’re self-employed, you pay both sides of that. A business tax preparer can help calculate self-employment tax obligations accurately.

Other 1099 forms California taxpayers see regularly

There are more than a dozen types of 1099 forms, but most California taxpayers will only deal with a few. According to the IRS, different payment types require different 1099 variants. Here are the common ones:

1099-NEC replaced the old Form 1099 MISC for reporting non-employee compensation. If you did freelance or contract work, this is the form you’ll get now instead of the older misc version. Many people still search for Form 1099-MISC when they should be looking for 1099-NEC.

1099-INT reports interest income from banks, credit unions, or other financial institutions. Even if you only earned $10 in interest, you’re supposed to report it. Most banks send this form if you earned more than $10 during the year.

1099-DIV reports dividend income and capital gain distributions from investments. If you have stocks, mutual funds, or other investments, you’ll get this from your brokerage.

1099-K reports payment card and third-party network transactions. If you sold items online, got paid through Venmo or PayPal for business transactions, or ran sales through a payment platform, you might receive this form. The reporting threshold changed recently, so more people are getting these than in past years. A tax preparation service can help determine which 1099-K amounts need to be reported as business income.

Why California taxpayers need to pay attention to state copies

California’s Franchise Tax Board gets copies of your 1099 forms just like the IRS does. That means if you report income differently on your state return than on your federal return, or if you leave something off your California return that shows up on a 1099, you’ll receive a notice from the state asking for an explanation.

This matters especially for people who work remotely for out-of-state companies or who have income from sources outside California. You still need to report it on your California return even if the income was earned elsewhere, as long as you’re a California resident. We at Prado Tax Services help clients navigate these situations by reviewing income carefully and ensuring it’s reported correctly across federal and California returns. If your income situation is complex or involves multiple states, working with a business tax preparer who understands California tax law can help prevent costly mistakes.

What about the 1099 G form? Unemployment and state payments

The 1099 G form reports payments you received from government sources during the year.

Unemployment benefits, state tax refunds, and other government payments that might be taxable all show up here. California taxpayers who collected unemployment or received a state tax refund in the previous year should expect to get this form, and it’s one that people often forget to include when they file. The 1099 G form is frequently overlooked but critically important.

Unemployment benefits are fully taxable at the federal level. A lot of people don’t realise that until they go to file and see the 1099 G sitting there with a big number in Box 1. California doesn’t tax unemployment benefits at the state level, but the IRS does, and you need to report that income on your federal return. If you didn’t have taxes withheld from your unemployment payments during the year, you might owe more than you expected when you file.

Some people opt to have taxes withheld when they apply for benefits, but many don’t think about it until tax season arrives and it’s too late to do anything except pay what’s owed. A personal tax preparer can help you understand your 1099 G form obligations and plan for any taxes owed.

When state refunds become taxable income

Unemployment benefits are fully taxable at the federal level. A lot of people don’t realize that until they go to file and see the 1099 G sitting there with a big number in Box 1. California doesn’t tax unemployment benefits at the state level, but the IRS does, and you need to report that income on your federal return. If you didn’t have taxes withheld from your unemployment payments during the year, you might owe more than you expected when you file.

Some people opt to have taxes withheld when they apply for benefits, but many don’t think about it until tax season arrives and it’s too late to do anything except pay what’s owed. Box 1 on your 1099 G shows the total amount of unemployment compensation you received. That full amount needs to be reported on your federal tax return, We at Prado Tax Services help clients understand how unemployment income affects their overall tax picture and avoid surprises when filing.

State tax refunds and when they count as income

Box 2 on the 1099 g form shows state or local income tax refunds you received. Not everyone who gets a state refund has to report it as income on their federal return, though. It depends on whether you itemized deductions in the prior year or took the standard deduction.

Did you take the standard deduction last year? Your refund isn’t taxable, and you can ignore it.

Itemized and deducted state taxes on Schedule A? Then your refund might be taxable income this year. The IRS wants to make sure you’re not getting a double benefit by deducting state taxes one year and then not reporting the refund as income the next. Most tax software will ask you whether you itemized last year and calculate this automatically, but if you’re doing your taxes by hand or working with a tax preparation service, make sure this gets handled correctly. Understanding your 1099 G form can prevent unexpected tax bills.

Box 6 reports taxable grants, which might apply if you received certain government assistance programs.

Box 9 shows the market gain from the sale of a principal residence that’s reported to the state. Most California taxpayers won’t have anything in these boxes, but if you do, it’s worth understanding what they mean before you file. Honestly, the 1099 G form catches people off guard more than almost any other tax form. You think you’re done gathering documents, and then you remember you collected unemployment for a few months or got a state refund last spring. Don’t skip it just because it doesn’t feel like “real” income. The IRS has a copy, and they’ll notice if it’s missing from your return. Professional tax services can help ensure all government payment forms are properly reported.

When to bring in a personal tax preparer or business tax preparer?

Most people can handle a simple tax return on their own, especially if they only have one W-2 and maybe some interest income. But once your tax situation gets more complicated, working with a personal tax preparer starts to make a lot more sense than trying to figure everything out yourself.

Here are some signs you should probably get help.

You have multiple income sources. W-2 from a full-time job, 1099s from freelance work, rental income, investment earnings, or side gig payments all add up to a more complex return. Each type of income gets reported differently, and missing something or putting it in the wrong spot can create problems with the IRS later. A personal tax preparer can organize multiple income streams efficiently.

You’re self-employed or run a small business. If you received a Form 1099-MISC or 1099-NEC for contract work, you’ll need to file Schedule C and pay self-employment tax. A business tax preparer knows how to handle deductions for business expenses, home office costs, mileage, and other write-offs that can lower your tax bill. They also understand quarterly estimated tax payments, which self-employed people are supposed to make throughout the year. Working with a business tax preparer can save you significantly more than their fee.

You had a major life change. Got married or divorced, bought a house, had a baby, moved to another state, or started a new business? These events all affect your taxes in different ways, and professional tax services can help you handle the changes without missing deductions or credits you’re entitled to.

What a personal tax preparer does that software can’t

Tax software is great for straightforward situations, but it can only ask the questions it’s programmed to ask. A personal tax preparer can look at your whole financial picture and catch things you might not think to mention. They know which deductions apply to your situation, how to handle unusual income, and what documentation you need to back up your claims if the IRS ever asks.

They also take responsibility for accuracy. If the software makes a mistake or you enter something wrong, that’s on you. If your tax preparer makes an error, they’re usually required to fix it at no extra cost, and many carry insurance that covers penalties or interest if something goes wrong. This peace of mind is one reason many people prefer a personal tax preparer over online tax filing alone.

Business tax preparers for more complex needs

If you’re running a business, even a small one, a business tax preparer brings expertise that goes beyond personal tax prep. They understand business structures, payroll taxes, depreciation, inventory accounting, and how to maximize deductions without raising red flags. They can also help with quarterly filings, sales tax compliance, and year-end planning, so you’re not scrambling every April.

Working with professional tax services doesn’t mean you hand everything over and hope for the best. You still need to organize your documents, provide accurate information, and review the return before it’s filed. But having someone who knows the tax code and can answer your questions makes the whole process less stressful and more likely to result in a correct return.

How professional tax services and online tax filing work together

Professional tax services and online tax filing aren’t competing options.

They can actually work together, depending on what you need and how comfortable you are handling your own taxes. Some people use online tax filing for simple years and switch to a tax preparer when things get complicated. Others use a preparer every year but appreciate having online access to their documents and filing status. The combination of professional tax services and online tax filing tools offers flexibility.

Online tax filing platforms have gotten pretty good at handling common tax situations. If you have W-2 forms for employees, some interest income, and maybe a student loan interest deduction, most software can walk you through the process step by step. The cost is usually lower than hiring someone, and you can file from home on your own schedule. But the trade-off is that you’re responsible for understanding what the software is asking and entering everything correctly. Many people start with online tax filing and transition to a tax preparation service as their finances become more complex.

Hybrid models that combine both approaches

Some tax preparation services now offer hybrid models where you do most of the data entry online, and then a preparer reviews everything before filing.

This can save money compared to a full-service option while still giving you the benefit of professional oversight. You get the convenience of online tax filing with the reassurance that someone experienced is checking your work. This works well for people who are mostly confident in their tax knowledge but want a second set of eyes on their return, especially if they have one or two complicated items like how to get W-2 form corrections handled or how to report income from a Form 1099-MISC accurately. We at Prado Tax Services offer guidance within these hybrid tax preparation models, helping clients balance convenience with accuracy. These hybrid tax preparation service models are growing in popularity.

What to look for in a tax preparation service

Not all tax preparers are the same. Look for someone who has credentials like an Enrolled Agent, CPA, or tax attorney designation. These professionals have passed exams and are required to stay current on tax law changes. Avoid preparers who promise bigger refunds than competitors or who base their fee on a percentage of your refund. Those are red flags.

A good tax preparation service will ask detailed questions about your income, deductions, and financial situation. They’ll explain what they’re doing and why, and they’ll make sure you understand your return before it’s filed. They should also be available after filing in case you get a notice from the IRS or need to amend your return later. Professional tax services can also help with tax planning, not just tax filing. They can suggest strategies for next year that might lower your tax bill, like adjusting your withholding, making retirement contributions, or timing certain expenses. That kind of advice is hard to get from software alone, and it can save you more than the cost of hiring a preparer in the first place.

Conclusion

Reviewing your W-2s and 1099s before filing isn’t just about avoiding mistakes. It’s about taking control of your tax return and making sure everything lines up before the IRS starts matching documents against what you submitted. California taxpayers deal with both federal and state reporting, and catching errors early means fewer headaches later.

Whether you’re handling a simple return on your own or working with a tax preparation service to manage multiple income sources, the key is verifying your forms as soon as they arrive. Check for accuracy, track down missing documents, and don’t wait until the last minute to sort out discrepancies. If your tax situation has gotten more complex this year or you’re not sure how to report something correctly, bringing in a personal tax preparer or business tax preparer can make the process smoother and help you file with confidence.

Tax season doesn’t have to be stressful. Start with your W-2s and 1099s, review them carefully, and reach out for help if you need it. Marlon at Prado Tax Services can help review your information and answer questions before you file, so you get it right the first time and avoid the time, cost, and frustration of dealing with IRS notices months down the road.